The European automotive industry stands at a critical juncture, facing challenges from both internal market realities and external competition, particularly from China. Jim Farley, CEO of Ford, has voiced significant concerns about the future of electric vehicle (EV) production in Europe, warning of a potential decline if current policies aren’t re-evaluated. His statements highlight a growing tension between ambitious environmental goals and the practicalities of consumer demand and industrial capacity. This article delves into Farley’s warnings, the issues facing the صناعة السيارات الكهربائية (electric vehicle industry), and the potential paths forward for Europe.

تراجع إنتاج السيارات الكهربائية في أوروبا وتأثيره (Decline in EV Production in Europe and its Impact)

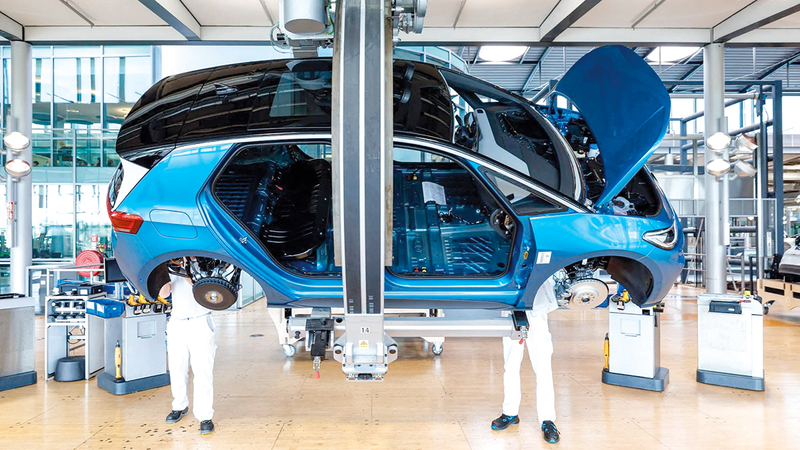

Farley points to a stark reality: current EV production in the European Union is three million units lower than pre-pandemic levels. This decline isn’t simply a result of lingering supply chain issues. It’s a symptom of a broader disconnect between policy and market acceptance. While European lawmakers are pushing for rapid electrification, consumer uptake hasn’t kept pace. This discrepancy is creating a precarious situation for European automakers, who are struggling to compete with the influx of cheaper, government-subsidized EVs from China.

The situation is further complicated by inconsistent policies. The UK, for example, recently introduced a new tax on electric vehicle mileage, despite offering purchase subsidies. Such contradictory measures create confusion and discourage potential buyers. This inconsistency undermines the long-term planning needed for successful EV adoption.

المنافسة الصينية وتحديات التصنيع الأوروبي (Chinese Competition and European Manufacturing Challenges)

The core of Farley’s concern lies in the aggressive expansion of Chinese EV manufacturers into the European market. These companies benefit from substantial government support, allowing them to offer vehicles at significantly lower prices. Furthermore, their production models are, according to Farley, “structurally designed to undermine European labor and manufacturing.”

China is poised to have a massive overcapacity in EV production, capable of meeting the entire demand of the European new car market. Already, Chinese brands have doubled their market share in Europe within just 12 months, reaching a record 5.5% in August. Meanwhile, the overall EV market share in the EU remains stagnant at around 16%, far short of the 25% target set for 2025. This highlights the growing dominance of Chinese manufacturers and the struggle of European companies to maintain their position. The سيارات كهربائية صينية (Chinese electric vehicles) are becoming increasingly attractive due to their price point and improving technology.

الحاجة إلى خطة واقعية لإعادة هيكلة الصناعة (The Need for a Realistic Restructuring Plan)

Farley emphasizes that the European automotive industry isn’t asking for financial handouts or protectionist measures. Instead, he calls for a “reset” – a long-term, realistic regulatory framework that provides manufacturers with the certainty they need to invest and innovate. He argues that the current approach, characterized by stringent emissions targets and annual policy adjustments, is disruptive and hinders long-term planning.

“We need a plan to reset the mechanism in the long run,” Farley stated, adding that without such a plan, Europe risks becoming a “museum of 21st-century manufacturing.” This requires a shift in focus towards fostering a thriving and competitive automotive industry, rather than rigidly adhering to unattainable goals. A key component of this plan should be allowing for a longer transition period for hybrid vehicles, bridging the gap until EVs become more affordable and accessible to a wider range of consumers.

الاستثمار في البنية التحتية والحوافز المستمرة (Investing in Infrastructure and Continued Incentives)

European automakers have already invested hundreds of billions of euros in developing and manufacturing electric vehicles. However, this investment needs to be matched by government support in the form of sustained purchase incentives and a robust charging infrastructure. This infrastructure must extend beyond urban centers to include rural areas, ensuring that EV ownership is viable for all citizens. Without adequate infrastructure, the adoption of المركبات الكهربائية (electric vehicles) will remain limited.

Farley also criticizes the current approach to commercial vehicles, arguing that treating them like luxury cars with strict emissions regulations is a “tax on the backbone of the European economy.” He points out that only 8% of new commercial vehicles are electric, yet they are subject to the same stringent rules as passenger EVs. This disproportionately impacts small and medium-sized enterprises (SMEs), which contribute significantly to Europe’s GDP.

مستقبل صناعة السيارات الأوروبية: خياران حاسمان (The Future of the European Automotive Industry: Two Crucial Options)

In conclusion, Jim Farley’s warning serves as a wake-up call for European policymakers. The continent faces a critical choice: either embrace a proactive strategy to revitalize its automotive industry and lead the world in green technology, or cling to unrealistic targets and risk surrendering its market to foreign competition.

Ford, with a century-long presence in Europe, remains committed to the region and plans to continue investing. However, Farley stresses that Europe must create a stable and predictable environment for manufacturers to thrive. The future of the صناعة السيارات (automotive industry) in Europe hinges on a pragmatic and forward-looking approach that balances environmental ambition with economic reality and consumer acceptance. Ignoring these challenges could lead to a significant loss of jobs, economic instability, and a diminished role for Europe in the global automotive landscape.